FCPA prosecution is historically ‘quiet’ in the months following a Presidential inauguration. This is to be expected given the changeover in leadership positions at both the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC). But barely two months into the second Trump administration and there have been major developments in FCPA enforcement, and more are to come.

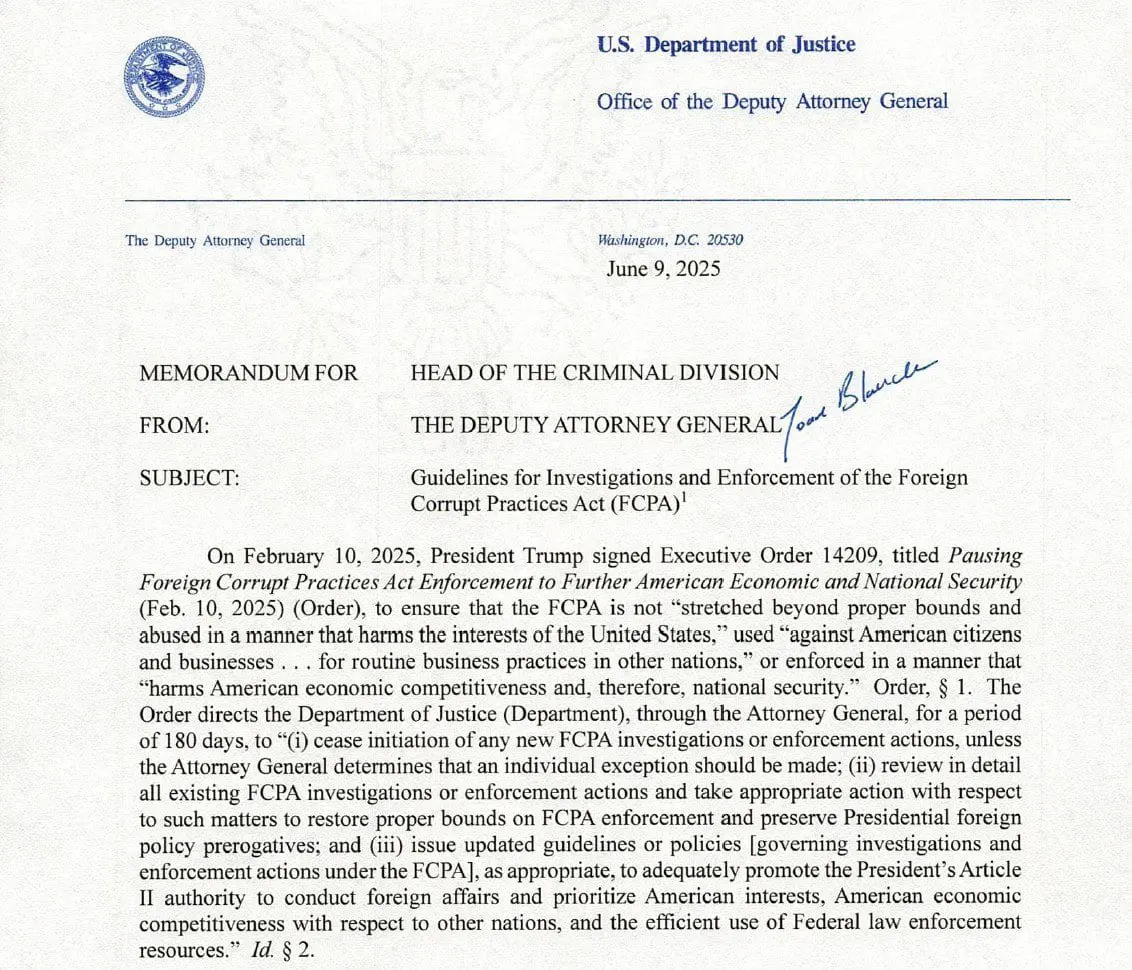

The Bondi Memo

FCPA Executive Order

According to EO 63, current FCPA enforcement hampers American competitiveness in the global market, including critical sectors such as infrastructure and national security-related assets like minerals and ports. The order claims that excessive enforcement ties up prosecutorial resources that could be better used elsewhere.

EO 63 directs AG Bondi to review and revise the guidelines governing FCPA investigations and enforcement actions over the next 180 days. During which time, all current FCPA cases will be reviewed and no new cases will be initiated unless the AG issues an exemption.

Reaction to EO 63

Most FCPA practitioners reacted with alarm to EO 63, whereas others viewed it as an overdue reining-in of FCPA prosecutions. Regardless of which view one takes, the future of FCPA prosecution will not be clear until AG Bondi issues the new guidelines, the SEC indicates how it will approach FCPA cases and we see the results of the new policies in practice.

Additionally, while EO 63 was huge news for FCPA practitioners, it ought to be viewed in the context of the Trump administration’s broader priorities. EO 63 was the 63rd executive order Trump signed this year. It came after executive orders addressing the use of paper straws, renaming geographic landmarks and establishing the White House Office of Faith.

That is not to say that the elimination of paper straws is a higher priority for the White House than reforming FCPA prosecution, but perspective is important. For example, EO 63 (oddly) came just days after AG Bondi had already issued revised guidance on FCPA prosecutions. But EO 63 came two days before Trump met with Indian Prime Minister Narendra Modi, who is widely understood to be lobbying for the dropping of FCPA charges against Indian billionaire and close friend of Modi, Guatam Adani. (When asked, Modi denied that he raised the issue of Adani’s charges with Trump).

Commentators will continue to speculate on the future of the FCPA and the intention of EO 63, but we will likely have a clearer picture in the next 12 months.

Record FCPA Reporting in 2024

The reason for the sudden spike in FCPA reports is not entirely clear, but given the sudden and unexpected increase, we would not rule out that it might be the result of something other than a surge in FCPA reporting. For instance, in 2024, the SEC changed its online TCR intake form, which may have resulted in more people selecting “FCPA” as the basis of their report. Similarly, the SEC reported that in FY2024, just two individuals filed 14,000 tips, meaning that the jump in figures might also be explained by a single individual reporting the same violation multiple times. Again, more clarity is likely to be provided in the next 12 months when the FY2024 results can be compared to the FY2025 results.